This story was part of our weekly newsletter. For early access to more such stories consider subscribing to the newsletter.

Who can forget Hindenburg Research’s explosive report about the Adani Group that made several damning allegations against the conglomerate and sent its stocks into freefall?

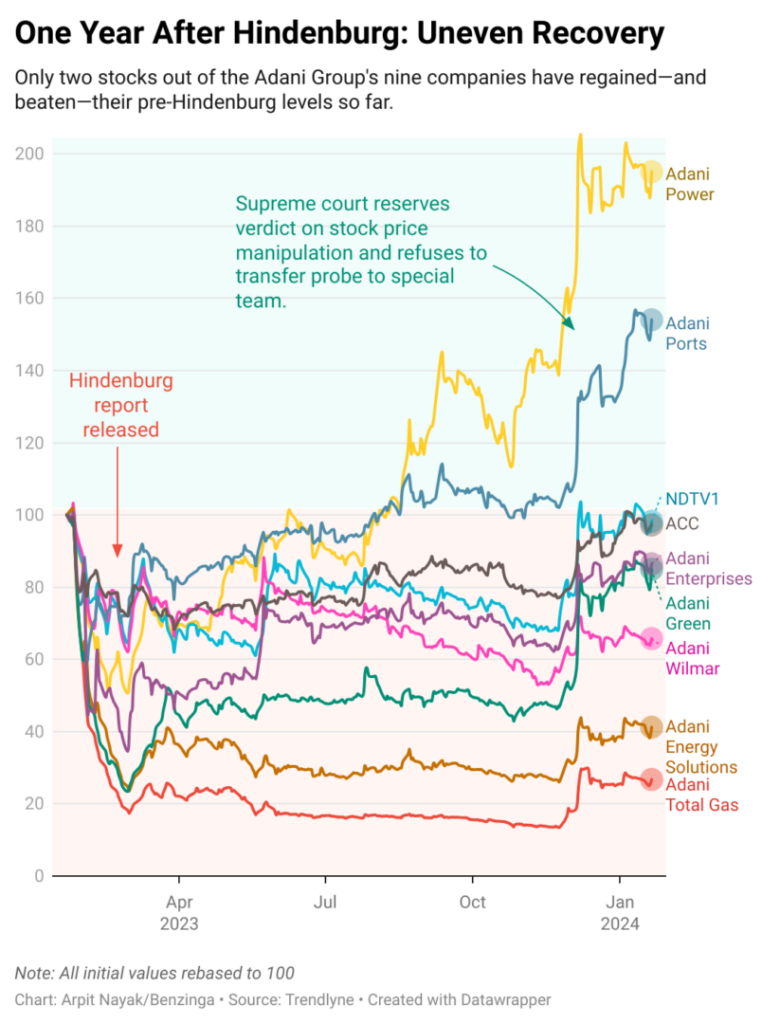

A year later, though, the Group seems to be finding its way back. Most of the conglomerate's stocks have nearly recovered their losses since the Hindenburg shock—and some like Adani Power and Adani Ports have even reached new heights.

it’s not like the Group made it out unscathed, though. Within a month of the report, which accused Gautam Adani of pulling the “largest con in corporate history”, the group's listed entities shed around $150 billion (₹12.41 lakh crore). Adani Energy Solutions and Adani Total Gas still trade much below the pre-Hindenburg levels.

The report also increased scrutiny over the Group. The conglomerate and its leader were put under scanner for a while.

From the Supreme Court disregarding the Hindenburg Report to a US body's clean chit to Adani Ports, the group's credibility may have been salvaged in many investors’ eyes. While SEBI's investigation into the allegations is still ongoing, it seems that the worst might just be over for the conglomerate. But many of its stocks still have a ways to go before they get back to their former glory.

Read Next: This Tata Stock Is Slumping 4% After Q3 — Analysts Think The Worst Is Yet To Come

Don't miss a beat on the share market. Get real-time updates on top stock movers and trading ideas on Benzinga India Telegram channel.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.