Ola Electric recently filed for a mammoth IPO where it plans to raise up to ₹5,500 crore in a fresh issue. Investors will likely keep a close eye on its issue price and any potential outlook.

Still, the company is likely to make a big splash when it lists in 2024. Ola Electric has had quite a journey after being founded in 2017 and spun off in 2019.

Ola Electric would likely be looking to recreate some of the bumper gains that Tata Technologies saw when it listed in 2023. However, Ola Electric’s IPO may be much trickier to navigate than that of the Tata Group stock.

We took a deeper look to break down the red and green flags in Ola Electric’s business and potential as it stands at the moment.

Ola Electric IPO: Pros

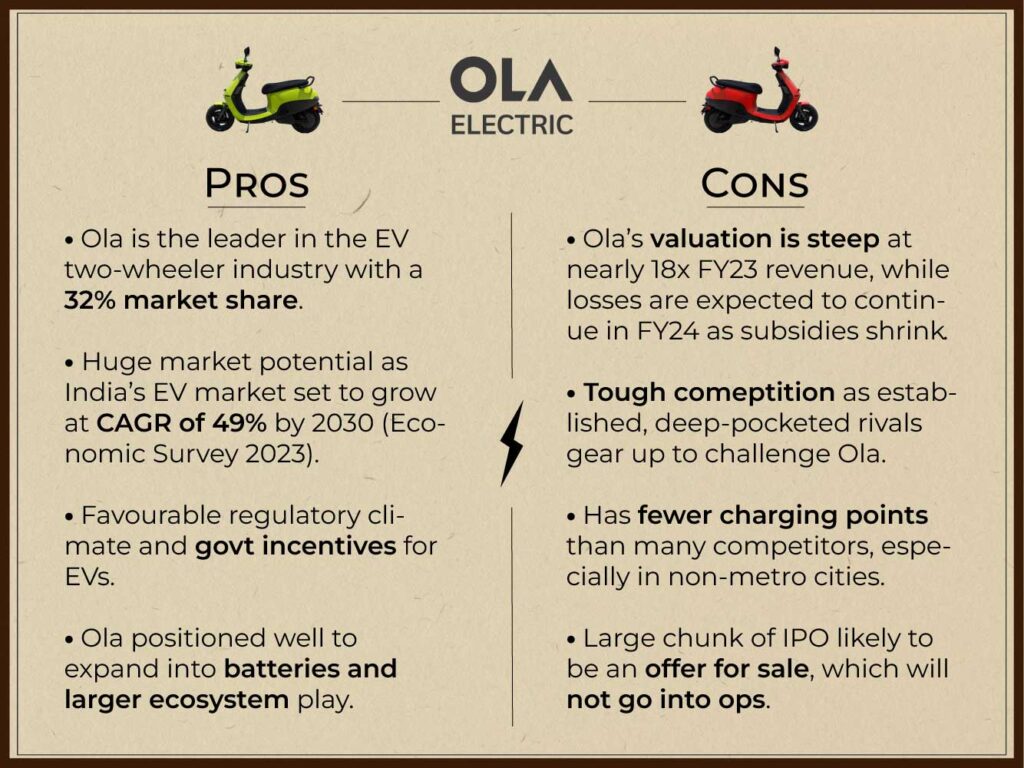

Among the factors that Ola Electric has going for it, the huge market potential of electric two-wheelers is at the top. The sector is likely to see a compound annual growth of 49% between 2022 and 2030, with one crore units in annual sales by 2030, according to estimates by the Economic Survey 2023.

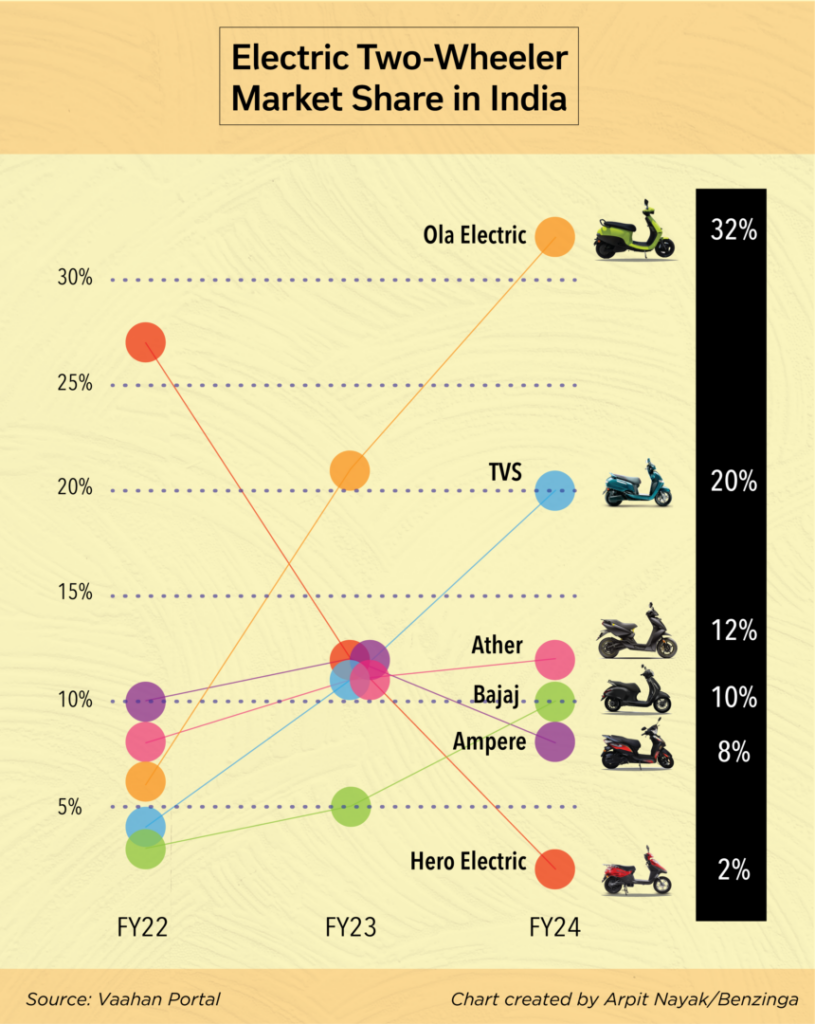

Ola is also currently the leader in the electric two-wheeler market with a 32% market share, handily beating TVS at second place with a 20% share and Ather at third with a 12% share.

Another key positive is that Ola Electric is looking to use the fresh capital to invest in expanding into cars, batteries and cells, building on its current investments into a massive “gigafactory”. Ola Electric could use the funding boost to power a much larger ecosystem play and get ahead of the curve.

See Also: Tata Sons Hunting For PE Suitors For Minority Stake In Tata Digital: Report

Ola Electric has also so far been a beneficiary of government incentives for electric vehicles, such as the FLAME subsidies, although policy support has weakened recently.

Ola Electric IPO: Cons

Despite it being set to be the first electric vehicle maker to go public, Ola also has a number of obstacles to face as it takes the plunge into public markets.

To start off, Ola Electric has reportedly been eyeing a valuation of up to $8 billion (₹66,655 crore). This is comparable to the main business of legacy firms like Hero MotoCorp and TVS.

However, Ola Electric is yet to prove its profitmaking abilities and has reportedly cut its sales target for FY24 to 300,000 e-scooter from its earlier goal of 882,000, Reuters reported. It also reportedly slashed its revenue target by 60% to $1.55 billion.

Ola also lags behind some of its competitors significantly when it comes to charging points across the country. It has only 224 hypercharging points across over 50 cities, while rival Ather has more than 1,400. Moreover, Hero MotoCorp, which owns a stake in Ather, has inked a pact with the latter to create an interoperable fast-charging network.

See Also: Oil’s Not Well: Mumbai Police Nab Thieves Who Stole 12,000 Litres Of Diesel

This story is based on Benzinga India’s exclusive weekly newsletter. You can click here to subscribe for free and stay up to date with the latest happenings in the world of stocks, business and investing.

Don't miss a beat on the share market. Get real-time updates on top stock movers and trading ideas on Benzinga India Telegram channel.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.