Shares of Zomato were gaining after reports that China’s Alipay was likely to dump its entire stake in the Indian food delivery platform.

What Happened: Chinese payment giant Alipay, a subsidiary of Ant Group, was poised to sell its entire 3.44% stake in Indian food delivery powerhouse Zomato for a substantial sum of nearly $400 million (₹3,331 crore). The plan involves executing block deals on Indian stock exchanges, Reuters reported, citing sources and an analysis of the deal’s term sheet.

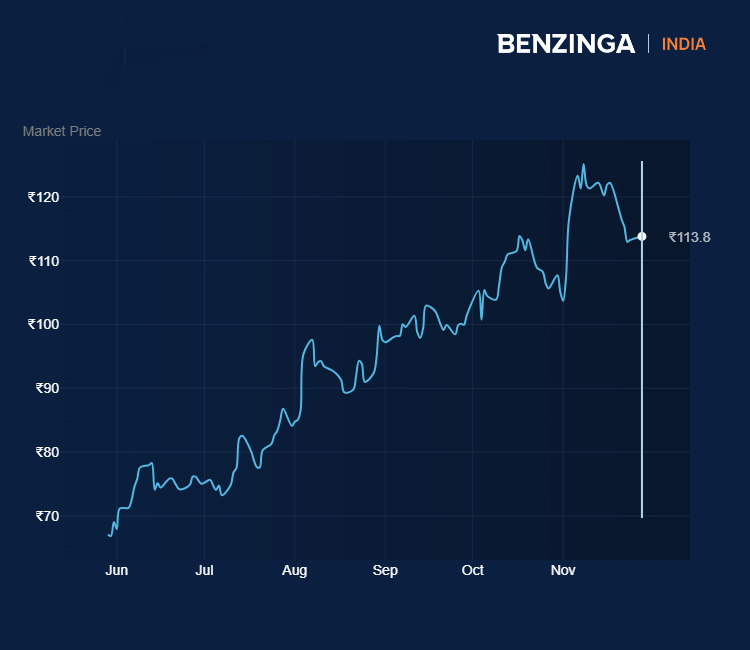

The transaction, anticipated to unfold later this week on Indian exchanges, aims to capitalise on Zomato’s soaring stock prices, which have seen a surge of over 90% in the current year.

See Also: Why Tata Power Share Price Is Upbeat Today

Why It Matters: Zomato, a major player in India’s food delivery service sector, had a tumultuous 2022 as tech stocks globally faced challenges. However, its recent resurgence has likely prompted Alipay to cash out at an opportune time. The stock has surged up over 70% in the past six months.

The block deals are slated to be executed at ₹111.28 per share, representing a 2.2% discount to Zomato’s closing price on Tuesday, according to the term sheet.

This move follows a trend among Chinese investors, with Antfin selling a 10.3% stake in financial giant Paytm in August.

Price Action: Zomato shares were up 3.51% at ₹117.80 near the start of trade on Wednesday.

Don't miss a beat on the share market. Get real-time updates on top stock movers and trading ideas on Benzinga India Telegram channel.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.