With increasing focus on renewable energy, the companies in the space have been creating a lot of waves. Two such companies that have been riding this wave are Suzlon and Inox Wind Energy. Both stocks have had a great year at the bourses and have given multibagger returns to investors.

Suzlon has been spelling a comeback after over a decade-long struggle. The company on the back of fresh orders and debt management seems to have gained back investor confidence. You can read all about Suzlon and its journey here.

See Also: Is Olectra Greentech Share A Good Buy?

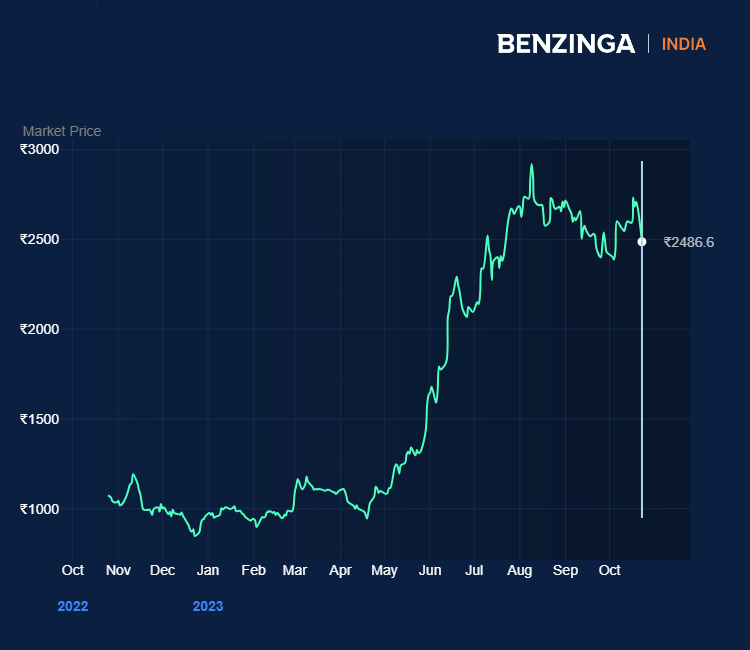

Now, as the chart depicts, Suzlon’s share price has risen around 280% from the ₹6-₹8 levels last October to reach over ₹30 levels currently.

Inox Wind Energy has also had a similar trajectory. Since last October the company has seen its share price more than double. Inox Wind Energy was established in 2020 with a primary focus on wind energy generation and its sale. IWEL is involved in providing erection, procurement, and commissioning (EPC) services to wind farms. IWEL serves as the holding company of Inox Wind Limited (IWL) – shares of which have also surged around 80% since the start of the year.

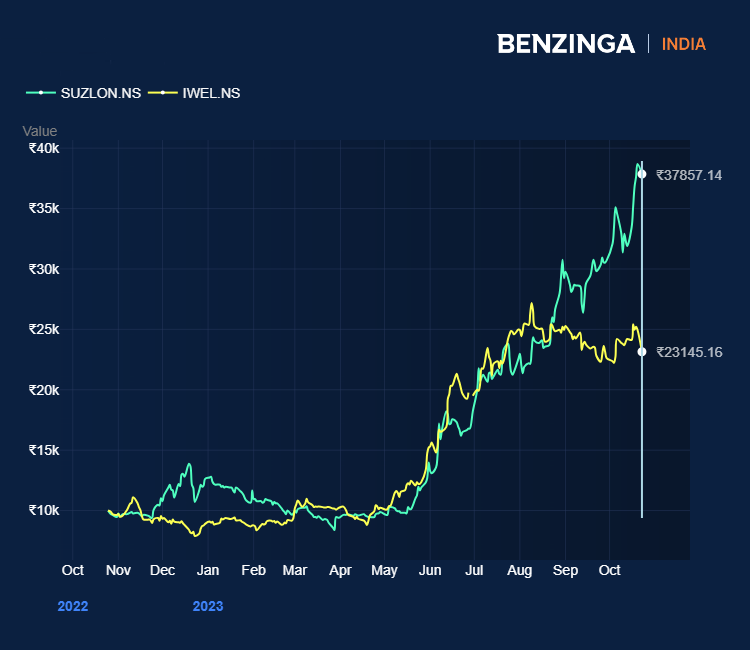

So, both wind energy majors have had a great year, but which would have given better results?

As the above chart shows, while a hypothetical ₹10,000 investment in Inox Wind Energy would have given great returns, they would still have been no match for the returns one could earn from the same investment in Suzlon.

Don't miss a beat on the share market. Get real-time updates on top stock movers and trading ideas on Benzinga India Telegram channel.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.