During times of turbulence and uncertainty in the markets, many investors turn to dividend-yielding stocks. These are often companies that have high free cash flows and reward shareholders with a high dividend payout.

Benzinga readers can review the latest analyst takes on their favorite stocks by visiting Analyst Stock Ratings page. Traders can sort through Benzinga's extensive database of analyst ratings, including by analyst accuracy.

Below are the ratings of the most accurate analysts for three high-yielding stocks in the health care sector.

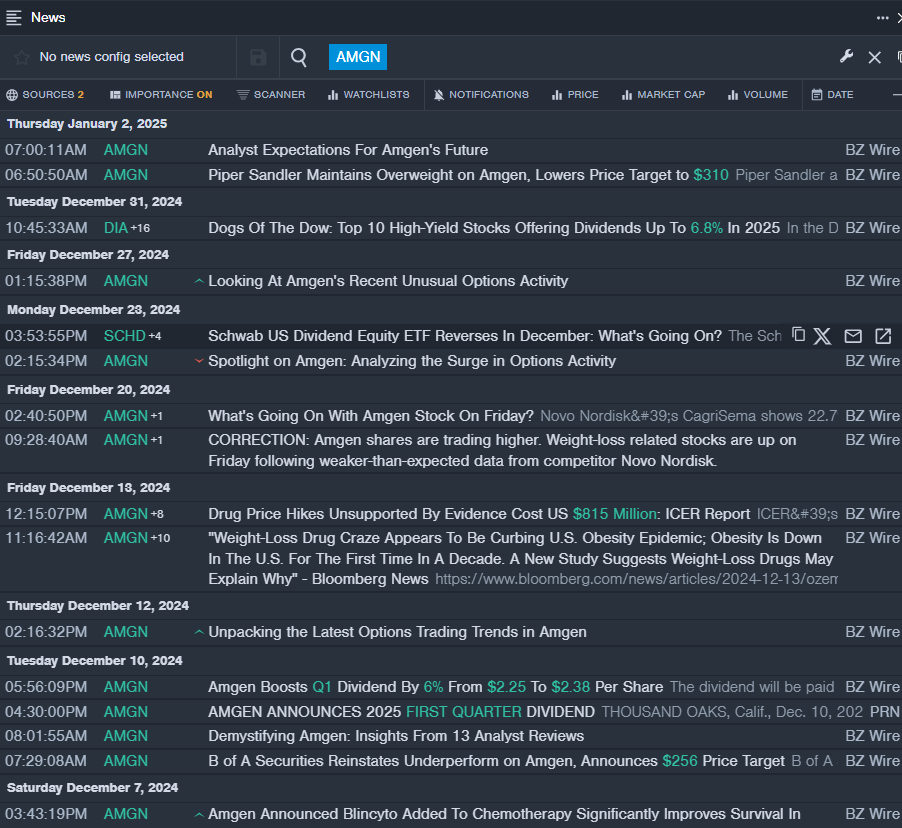

Amgen Inc. AMGN

- Dividend Yield: 3.67%

- Piper Sandler analyst David Amsellem maintained an Overweight rating and cut the price target from $344 to $310 on Jan. 2. This analyst has an accuracy rate of 66%.

- B of A Securities analyst Tim Anderson reinstated an Underperform rating with a price target of $256 on Dec. 10. This analyst has an accuracy rate of 63%.

- Recent News: On Dec. 10, Amgen increased its first-quarter dividend by 6% from $2.25 to $2.38 per share.

- Benzinga Pro's real-time newsfeed alerted to latest AMGN news.

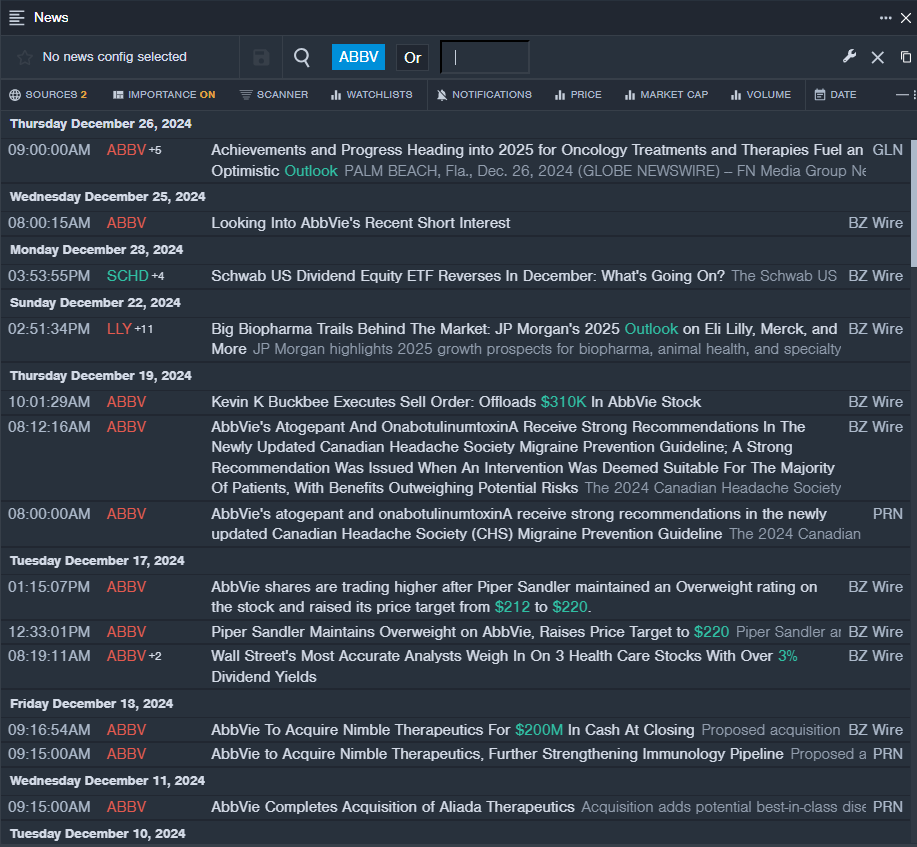

AbbVie Inc. ABBV

- Dividend Yield: 3.66%

- B of A Securities analyst Tim Anderson reinstated a Neutral rating with a price target of $191 on Dec. 10. This analyst has an accuracy rate of 63%.

- Leerink Partners analyst David Risinger upgraded the stock from Market Perform to Outperform with a price target of $206 on Nov. 22. This analyst has an accuracy rate of 75%.

- Recent News: On Dec. 13, AbbVie announced plans to acquire Nimble Therapeutics.

- Benzinga Pro's real-time newsfeed alerted to latest ABBV news

CVS Health Corporation CVS

- Dividend Yield: 6.02%

- Deutsche Bank analyst George Hill upgraded the stock from Hold to Buy with a price target of $66 on Dec. 3. This analyst has an accuracy rate of 60%.

- Truist Securities analyst David Macdonald reiterated a Buy rating and lowered the price target from $76 to $67 on Nov. 20. This analyst has an accuracy rate of 63%.

- Recent News: The DOJ recently alleged that CVS violated the Controlled Substances Act by filling unlawful prescriptions for opioid combinations and excessive quantities since 2013.

- Benzinga Pro’s charting tool helped identify the trend in CVS stock.

Read More:

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

Loading...

date | ticker | name | Price Target | Upside/Downside | Recommendation | Firm |

|---|