Diwali, the festival of lights, holds special significance for the Indian stock market. While the markets are closed for regular trading on the day, a symbolic session known as “Muhurat Trading” is conducted every year.

This tradition is believed to bring prosperity and good fortune, with traders and investors making symbolic purchases to mark the beginning of the new financial year.

Ahead of Diwali, brokerage firm Sharekhan has selected key stocks for investors. Here are some stocks the analysts see outperforming this year.

HUDCO

Sharekhan believes that HUDCO is poised for a strong growth trajectory, likely to deliver a healthy compound annual growth rate (CAGR) of around 17% in book value, fueled by a robust earnings growth rate of around 31% CAGR in its loan book over FY2024-27.

This would present a significant upside of around 64% from its current market price. With the government’s focus on affordable housing and urban infrastructure development, HUDCO stands to benefit immensely, providing strong growth visibility for the next five years.

Additionally, HUDCO’s recent reclassification as a non-banking financial company (NBFC) focused on infrastructure finance (as opposed to its previous Housing Finance Company status) broadens its scope to finance various infrastructure projects, including renewable energy, smart cities and green infrastructure, according to the brokerage.

This, combined with the minimal risk exposure due to most of HUDCO's government-backed projects, reinforces its strong growth potential, the brokerage notes. However, risks such as execution challenges, regulatory hurdles and delays in state government repayments remain key concerns.

Tata Motors

Tata Motors continues to show resilience across its business verticals, with Jaguar Land Rover (JLR) maintaining healthy EBITDA margins and generating positive free cash flow despite supply disruptions and global demand uncertainties, according to Sharekhan.

JLR has set a target of 8.5% or more EBIT margin target for FY2025, reflecting the company’s operational efficiency. In the commercial vehicle (CV) segment, Tata Motors’ shift from discount-driven sales to profitable volume growth is expected to enhance EBITDA margins.

In the domestic passenger vehicle (PV) segment, Tata Motors has significantly increased its market share, driven by new products and the rising demand for sports utility vehicles. Its market share has grown from 5% in FY20 to 13.3% in H1FY25.

The brokerage expects the acquisition of Ford’s plant to further boost production capacity. While consistent performance in JLR, PV and CV segments bodes well for Tata Motors, key risks such as a global cyclical downturn could affect its diversified revenue streams, it added.

See Also: RVNL Establishes New Subsidiary In Saudi Arabia

L&T

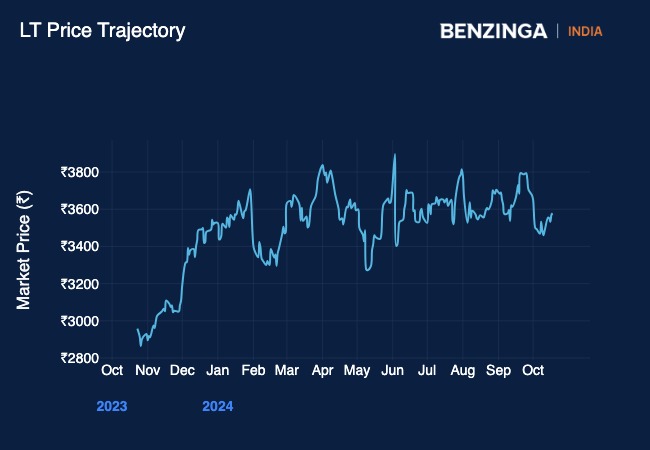

As per the analysts, Larsen & Toubro is poised for sustained growth, with the company targeting a 10% year-on-year growth in order inflows, 15% revenue growth and an operating profit margin (OPM) of 8-8.25% for FY2025 in its core projects and manufacturing (P&M) business.

With a robust order book valued at ₹4.91 lakh crore, the company is well-positioned to continue its growth trajectory, the research firm said. L&T has seen strong order inflows across multiple sectors, particularly from the Middle East.

L&T's stock currently trades at a price-to-earnings ratio of 28.5 and 23.9 for its FY26 and FY27 earnings estimates, respectively, leaving room for potential upside given its strong international and domestic order pipeline, the analysts said. However, macroeconomic slowdowns or geopolitical conflicts could impact its order prospects, it cautioned.

Bharti Airtel

Bharti Airtel, one of India’s leading telecom operators, continues to benefit from increasing smartphone penetration and rising data consumption, positioning the company to capitalise on the growing demand for mobile internet services.

Airtel's significant investments in 5G infrastructure and its leadership in generating high average revenue per user (ARPU) in India's mobile segment bode well for future growth, according to Sharekhan.

The brokerage expects Airtel's recent tariff hikes and improving cash flows, coupled with moderation in capex intensity, will help the company in reducing debt. However, risks such as rising competition, slowing data growth and potential challenges in its Africa operations could impact revenue and growth, it said.

Read Next: Zomato Q2 Results: What Analysts Expect As Quick-Commerce Competition Gets Tighter

Disclaimer: This content was partially produced with the help of Benzinga Neuro and was reviewed and published by Benzinga editors.

Don't miss a beat on the share market. Get real-time updates on top stock movers and trading ideas on Benzinga India Telegram channel.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.