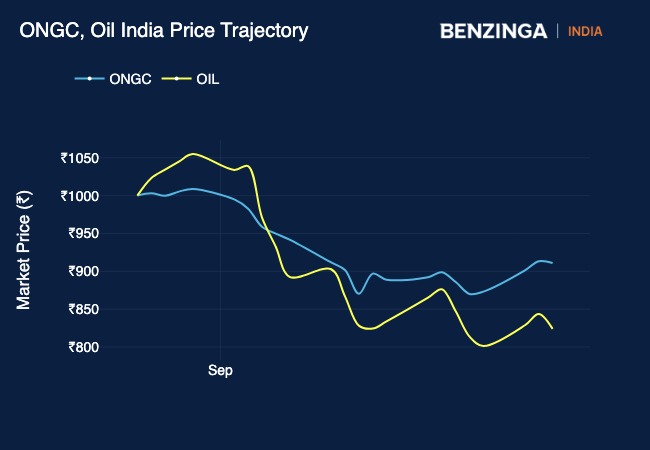

Shares of Oil India and ONGC have been under pressure for the past few weeks, but analysts at Motilal Oswal remain bullish on the stocks.

What Happened: Motilal Oswal reiterated its “buy” rating on ONGC and Oil India despite the risks associated with oil prices. The research firm pointed out that it had previously highlighted potential risks to crude oil realisation estimates for these companies, forecasting a price of $73-74 per barrel.

See Also: Trent Jumps Over 3% As Citi Initiates Coverage With ‘Buy’, Sees 21% Upside

Over the last four weeks, both ONGC and Oil India saw significant corrections, with their stock prices declining by 9% and 18%, respectively, due to the drop in crude prices. Motilal Oswal believes that ONGC and Oil India have now sufficiently factored in the risks related to oil price realisations, leading them to remain bullish on the oil producers.

The brokerage also highlighted that refining margins have been weak, with the Singapore gross refining margin averaging $3.6 per barrel in the first half of FY25. This reflects the subdued demand for oil globally, it said.

However, global inventories of key oil products are currently at the lower to mid-range of the past five years, indicating that refining margins may have limited downside. Motilal Oswal expects margins to stabilise, especially as the winter season approaches, which historically brings stronger demand.

The brokerage has a target price of ₹360 on ONGC while Oil India’s target price is set at ₹740.

Price Action: Oil India’s share price was down 0.88% to trade at ₹573.60. ONGC’s share price was down 1.51% to trade at ₹294.20 on Thursday.

Read Next: Why IEX Shares Are Rebounding Today After 17% Fall In 2 Days

Disclaimer: This content was partially produced with the help of Benzinga Neuro and was reviewed and published by Benzinga editors.

Don't miss a beat on the share market. Get real-time updates on top stock movers and trading ideas on Benzinga India Telegram channel.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.