A slew of announcements at the GTC AI Conference in San Jose, California failed to ignite the shares of Nvidia Corp. NVDA on Tuesday as it slipped over 3% in trade. The chipmaker led by Jensen Huang has wiped $420 billion in investor wealth since DeepSeek was launched on Jan. 10, 2025

What Happened: In a two-hour address at GTC, Huang detailed Nvidia’s upcoming two-year plans, including developments on their Blackwell and Rubin chips.

Huang also highlighted advancements in AI for robotics and telecommunications and revealed a new collaboration with General Motors Co. GM for AI manufacturing training.

However, these announcements did not help the stock as it fell by 3.43%, underperforming the Nasdaq 100 index which plunged 1.66%. The exchange-traded fund tracking the index, Invesco QQQ Trust, Series 1 QQQ also declined 1.70% on Tuesday.

According to the data from Benzinga Pro, Nvidia has declined 14.04% on a year-to-date basis, reducing investor wealth by $380 billion since Dec. 31, 2024, when its market capitalization stood at $3,297 billion as compared to the current $2,917 billion.

Similarly, when compared with the m-cap from the weekend when DeepSeek became the top application on Apple Inc.’s AAPL App Store, the metric has fallen $585 billion from Jan. 24.

The trailing price-to-earnings ratio for the company stood at 40.66x, which was the lowest in over two years or 29 months since Oct. 20, 2022.

Why It Matters: The Nasdaq has been trading in the correction zone since March 6 and the Magnificent 7 stocks have underperformed the market in 2025.

According to John Murillo, the chief dealing officer at B2BROKER, the technology rout is fueled by multiple reasons including the “interest rate sensitivity,” “unraveling trade tensions,” and the high concentration of these stocks in the benchmark indices amid the correction.

Meanwhile, China’s low-cost AI chips and open-source LLMs could deflate the ‘AI bubble,’ said Edward Yardeni, which will lead to lower AI spending and profitability for Magnificent 7 stocks.

Technical Analysis: Nvidia’s technical analysis paints a grim picture for the stock. The stock price at $115.43 apiece was in a bullish downtrend as it was lower than short and long-term moving averages.

While its, relative strength index was in the neutral zone at 44.03, the other momentum indicator, MACD was at -4.04 signaling a bearish trend with the potential of a weak downward momentum, given that the blue line was above the red line.

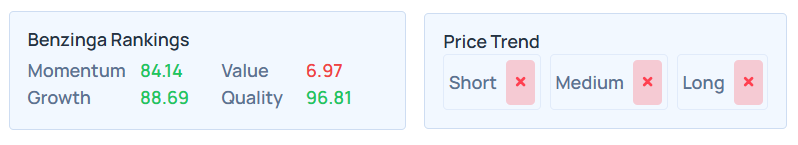

Price Action: Despite the recent fall Nvidia shares have risen 29.12% over a year. Benzinga's Edge Rankings show a poor price trend and value ranking for the stock. The stock’s momentum, fundamental growth, and quality rankings continue to be strong amid other pressures.

Its consensus price target was $175.95, with a ‘buy' rating, based on the 41 analysts tracked by Benzinga. The price targets ranged from a low of $120 to a high of $220. The three latest ratings from Mizuho, DA Davidson, and Cantor Fitzgerald averaged $167.67, implying a 46.08% upside.

Read Next:

Photo courtesy: Shutterstock

Don't miss a beat on the share market. Get real-time updates on top stock movers and trading ideas on Benzinga India Telegram channel.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.