The most oversold stocks in the consumer staples sector presents an opportunity to buy into undervalued companies.

The RSI is a momentum indicator, which compares a stock’s strength on days when prices go up to its strength on days when prices go down. When compared to a stock’s price action, it can give traders a better sense of how a stock may perform in the short term. An asset is typically considered oversold when the RSI is below 30, according to Benzinga Pro.

Here's the latest list of major oversold players in this sector, having an RSI near or below 30.

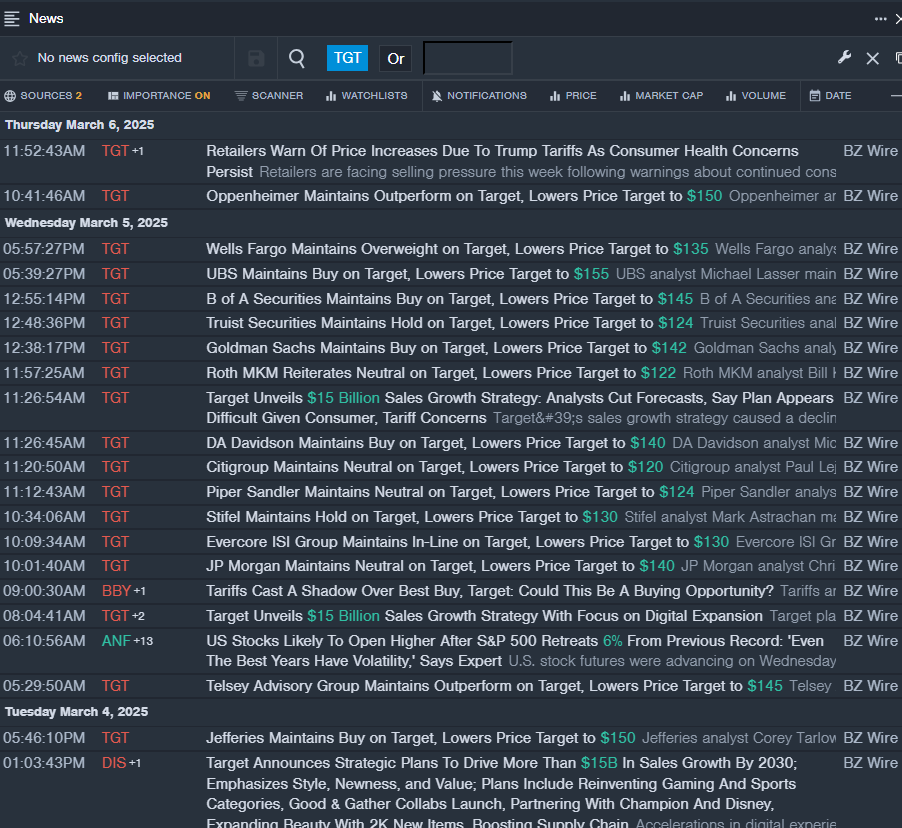

Target Corp TGT

- On March 4, the company reported a fourth-quarter sales decline of 3.1% year-on-year to $30.91 billion, beating the analyst consensus estimate of $30.84 billion. "Our team grew traffic and delivered better-than-expected sales and profitability in our biggest quarter of the year," said chair and chief executive officer Brian Cornell. The company's stock fell around 12% over the past month and has a 52-week low of $112.10.

- RSI Value: 29

- TGT Price Action: Shares of Target gained 0.9% to close at $115.08 on Friday.

- Benzinga Pro's real-time newsfeed alerted to latest TGT news.

Eastside Distilling Inc BLNE

- On Feb. 19, Eastside Distilling closed a $5 million private placement. Over half of the capital came from Nick Liuzza, the founder and CEO of Beeline Financial Holdings, who invested $2.9 million.. The company's stock fell around 2% over the past five days and has a 52-week low of $0.41.

- RSI Value: 19.1

- BLNE Price Action: Shares of Eastside Distilling gained 1.2% to close at $0.75 on Friday.

- Benzinga Pro’s charting tool helped identify the trend in BLNE stock.

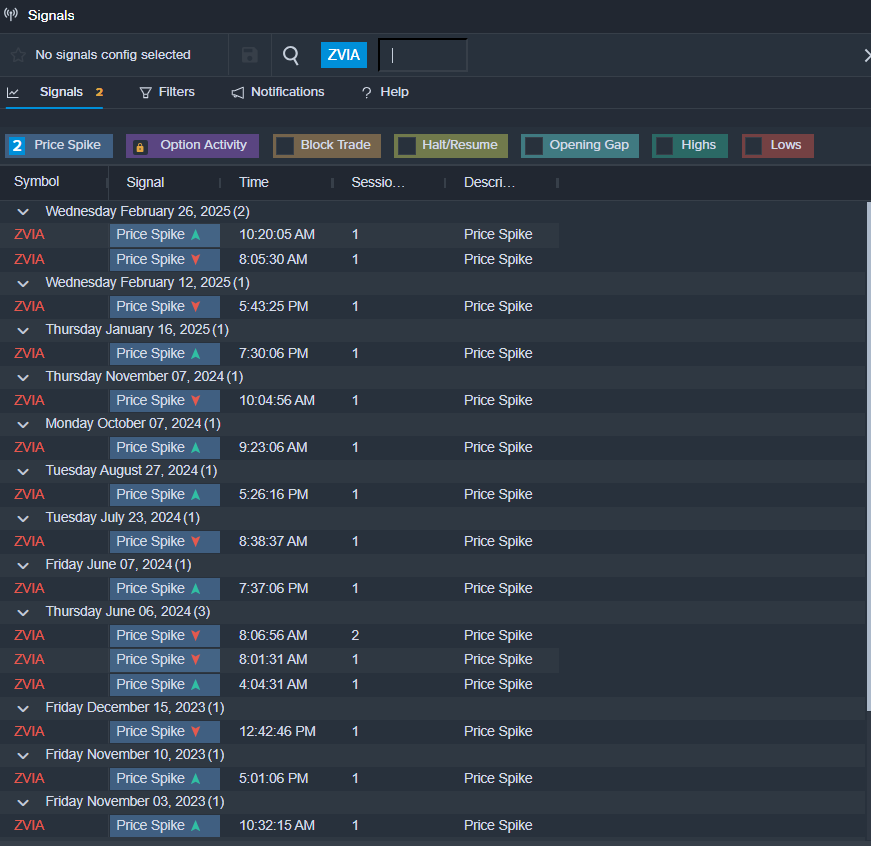

Zevia Pbc ZVIA

- On Feb. 26, Zevia issued FY25 revenue guidance below estimates. “We are pleased to have ended the year on a strong note with a return to top line growth and significant progress towards achieving profitability. We elevated our brand identity, advanced our three strategic growth pillars and continued to lay a strong foundation for growth and profitability over the long term.” said Amy Taylor, President and Chief Executive Officer of Zevia. The company's stock fell around 37% over the past month and has a 52-week low of $0.62.

- RSI Value: 27.5

- ZVIA Price Action: Shares of Zevia fell 2.7% to close at $2.17 on Friday.

- Benzinga Pro’s signals feature notified of a potential breakout in ZVIA shares.

Read This Next:

Don't miss a beat on the share market. Get real-time updates on top stock movers and trading ideas on Benzinga India Telegram channel.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.