Triumph Group, Inc. TGI reached a definitive acquisition agreement with private equity firms, Warburg Pincus and Berkshire Partners.

Valued at roughly $3 billion, the transaction will result in Triumph becoming a privately owned entity which will be jointly managed by Warburg Pincus and Berkshire Partners.

TRIUMPH shareholders will receive $26.00 per share in cash, representing a premium of about 123% to the unaffected closing stock price of $11.65 per share as of the close on October 9, 2024, the last full trading day before media reports regarding a possible sale transaction. The deal price represents a premium of over 38% to the last closing price of $18.74 on January 31, 2025.

"Over the last few years, TRIUMPH successfully optimized our portfolio, built around a world class team and capabilities. This transaction recognizes our Company's position as a valued provider of mission-critical engineered systems and proprietary components for both OEM and aftermarket customers," said Chairman, President and CEO, Dan Crowley.

Triumph Group shares gained 0.1% to trade at $25.08 on Tuesday.

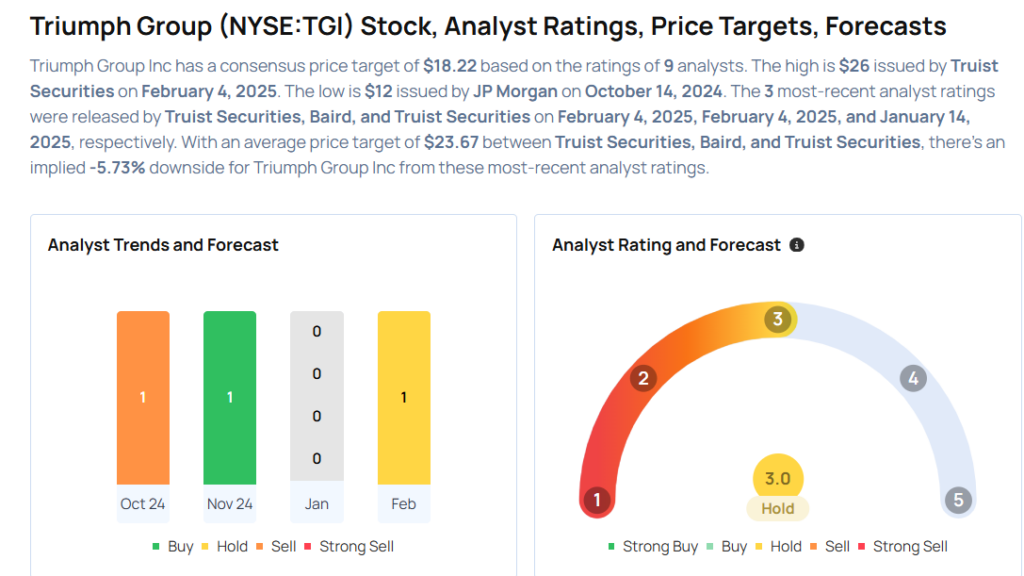

These analysts made changes to their price targets on Triumph Group following the announcement.

- Baird analyst Peter Arment downgraded Triumph Group from Outperform to Neutral and raised the price target from $20 to $26.

- Truist Securities analyst Michael Ciarmoli maintained Triumph Group with a Hold and raised the price target from $19 to $26.

Considering buying TGI stock? Here’s what analysts think:

Read This Next:

Don't miss a beat on the share market. Get real-time updates on top stock movers and trading ideas on Benzinga India Telegram channel.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

date | ticker | name | Price Target | Upside/Downside | Recommendation | Firm |

|---|