V.F. Corporation VFC reported better-than-expected third-quarter FY25 earnings on Wednesday.

The company reported third-quarter sales of $2.834 billion, beating the analyst consensus estimate of $2.746 billion. The North Face increased 5% Y/Y to $1.25 billion, Vans declined 9% to $607.6 million, Timberland jumped 11% to $527 million and Dickies plunged 10% to $133.6 million.

Adjusted EPS of 62 cents beat the analyst consensus of 34 cents.

"We made strong progress in Q3'25, improving profitability and further strengthening the balance sheet. The pace of VF's transformation is on track as we deliver against our Reinvent priorities," said President and CEO Bracken Darrell.

VF said it sees fourth-quarter revenue to decline (4)% – (6)%. The adjusted operating income for fourth-quarter FY25 is expected to be $(30) million – $0 million. VF sees FY25 free cash flow of $440 million, up from the previous guidance of $425 million.

VF shares fell 3.9% to close at $25.56 on Wednesday.

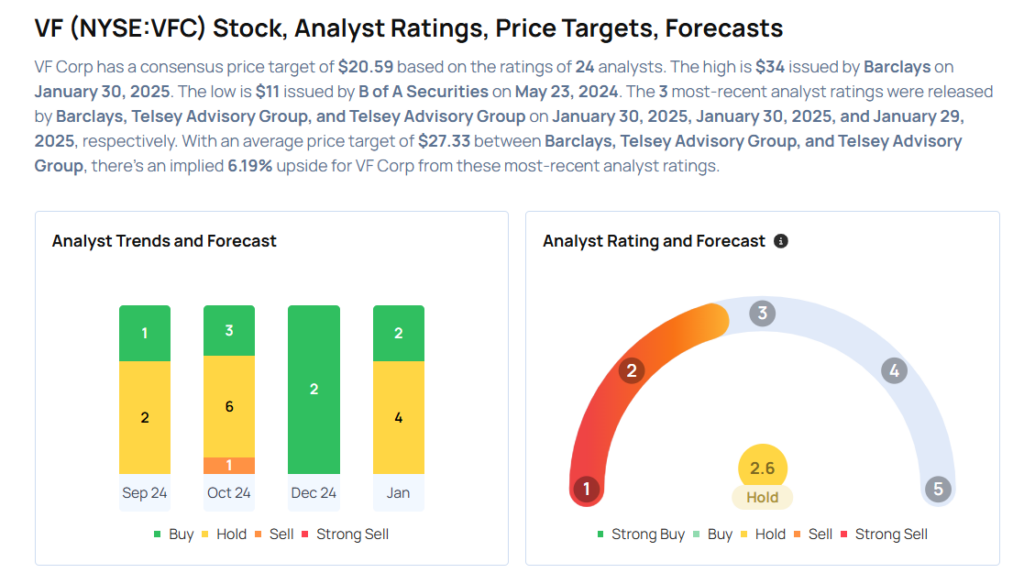

These analysts made changes to their price targets on VF following earnings announcement.

- Telsey Advisory Group analyst Dana Telsey maintained VF with a Market Perform and raised the price target from $21 to $27.

- Barclays analyst Adrienne Yih maintained the stock with an Overweight rating and raised the price target from $29 to $34.

Considering buying VFC stock? Here’s what analysts think:

Read This Next:

Don't miss a beat on the share market. Get real-time updates on top stock movers and trading ideas on Benzinga India Telegram channel.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.