Brinker International, Inc. EAT reported better-than-expected second-quarter results on Wednesday.

The company reported second-quarter adjusted earnings per share of $2.80 beating the street view of $1.79. Quarterly sales of $1.358 billion outpaced the analyst consensus estimate of $1.240 billion.

"Chili's sales comps accelerated to +31%, driven both by new guests trying Chili's and return guests coming more frequently despite a more competitive promotional environment," said President and CEO Kevin Hochman.

Brinker International said it expects FY25 revenues to be between $5.15 billion and $5.25 billion, higher than the analyst consensus estimate of $4.90 billion (prior view: $4.70 billion-$4.75 billion).

The company also projects adjusted EPS of $7.50 to $8.00 versus the street view of $6.36, up from the prior forecast of $5.20 to $5.50.

Brinker shares surged 16.3% to close at $179.79 on Wednesday.

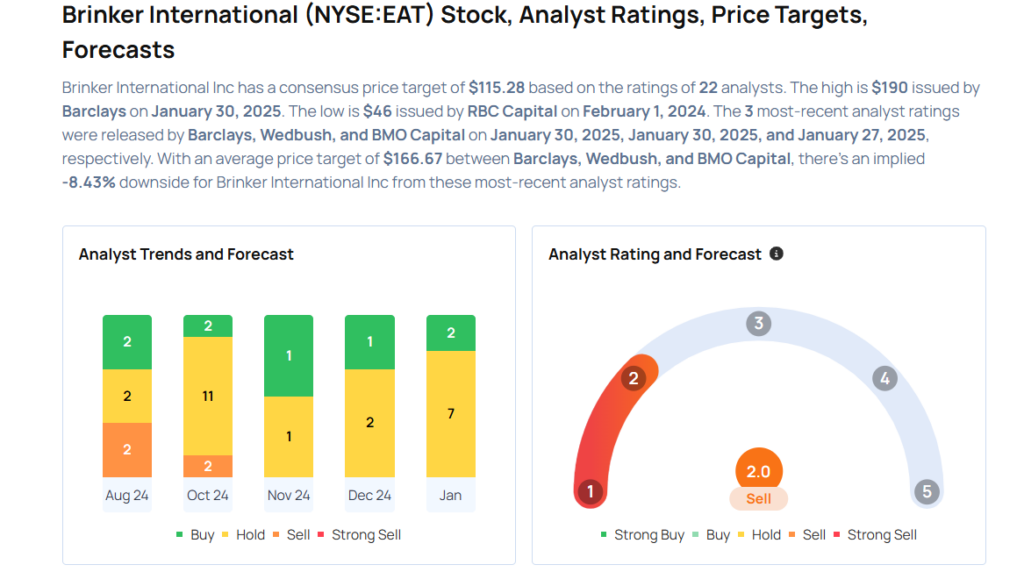

These analysts made changes to their price targets on Brinker following earnings announcement.

- Wedbush analyst Nick Setyan maintained Brinker International with a Neutral rating and raised the price target from $140 to $185.

- Barclays analyst Jeffrey Bernstein maintained Brinker International with an Equal-Weight rating and raised the price target from $150 to $190.

Considering buying EAT stock? Here’s what analysts think:

Read This Next:

Don't miss a beat on the share market. Get real-time updates on top stock movers and trading ideas on Benzinga India Telegram channel.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.