During times of turbulence and uncertainty in the markets, many investors turn to dividend-yielding stocks. These are often companies that have high free cash flows and reward shareholders with a high dividend payout.

Benzinga readers can review the latest analyst takes on their favorite stocks by visiting Analyst Stock Ratings page. Traders can sort through Benzinga's extensive database of analyst ratings, including by analyst accuracy.

Below are the ratings of the most accurate analysts for three high-yielding stocks in the consumer staples sector.

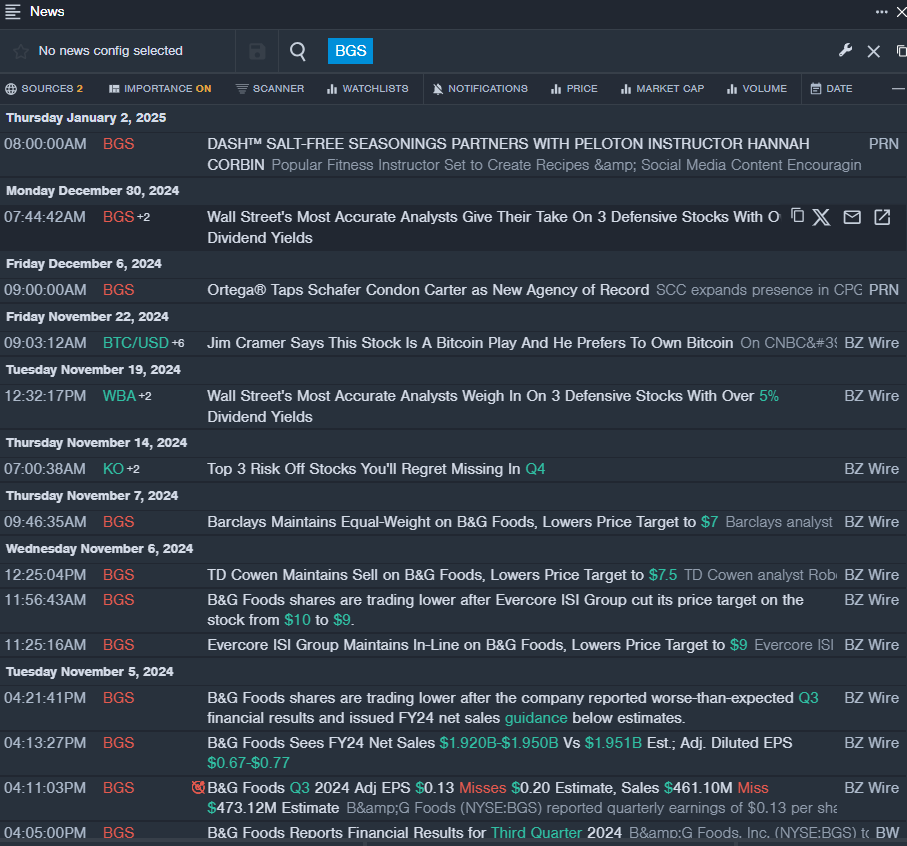

B&G Foods, Inc. BGS

- Dividend Yield: 11.62%

- Barclays analyst Brandt Montour maintained an Equal-Weight rating and lowered the price target from $8 to $7 on Nov. 7. This analyst has an accuracy rate of 65%.

- TD Cowen analyst Robert Moskow maintained a Sell rating and cut the price target from $8 to $7.5 on Nov. 6. This analyst has an accuracy rate of 67%.

- Recent News: On Nov. 5, B&G Foods reported worse-than-expected third-quarter financial results and issued FY24 net sales guidance below estimates.

- Benzinga Pro's real-time newsfeed alerted to latest BGS news.

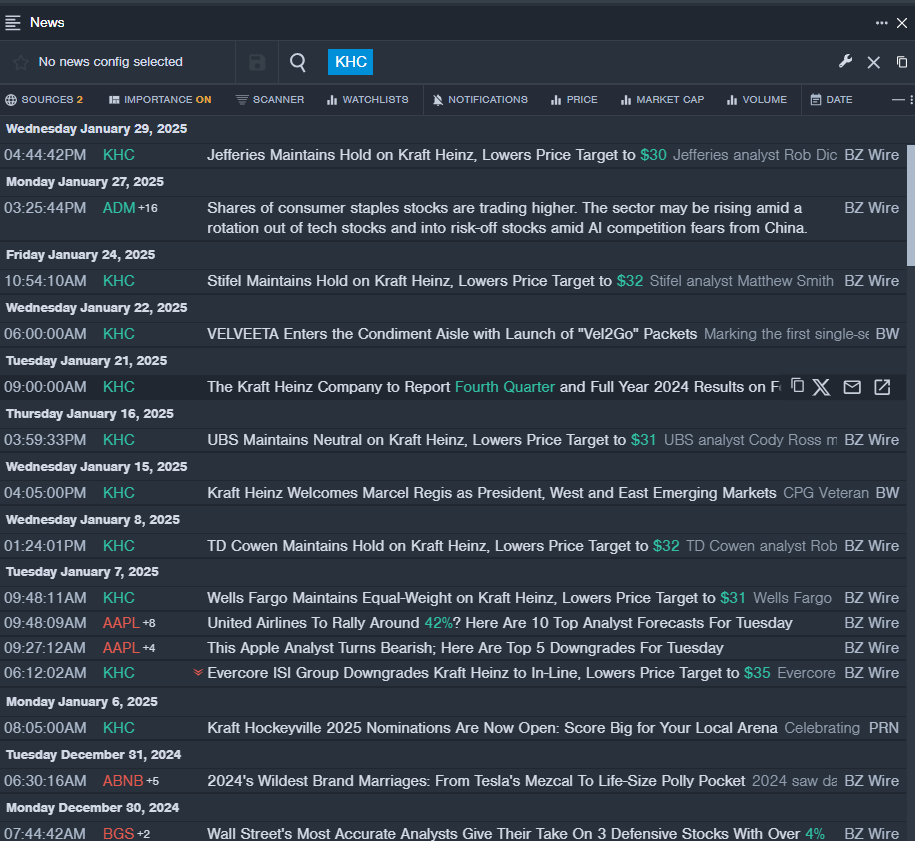

The Kraft Heinz Company KHC

- Dividend Yield: 5.39%

- Jefferies analyst Rob Dickerson maintained a Hold rating and cut the price target from $34 to $30 on Jan. 29, 2025. This analyst has an accuracy rate of 67%.

- Stifel analyst Matthew Smith maintained a Hold rating and cut the price target from $35 to $32 on Jan. 24, 2025. This analyst has an accuracy rate of 60%.

- Recent News: The Kraft Heinz Company will report fourth quarter and full year 2024 results on Feb. 12, 2025.

- Benzinga Pro's real-time newsfeed alerted to latest KHC news

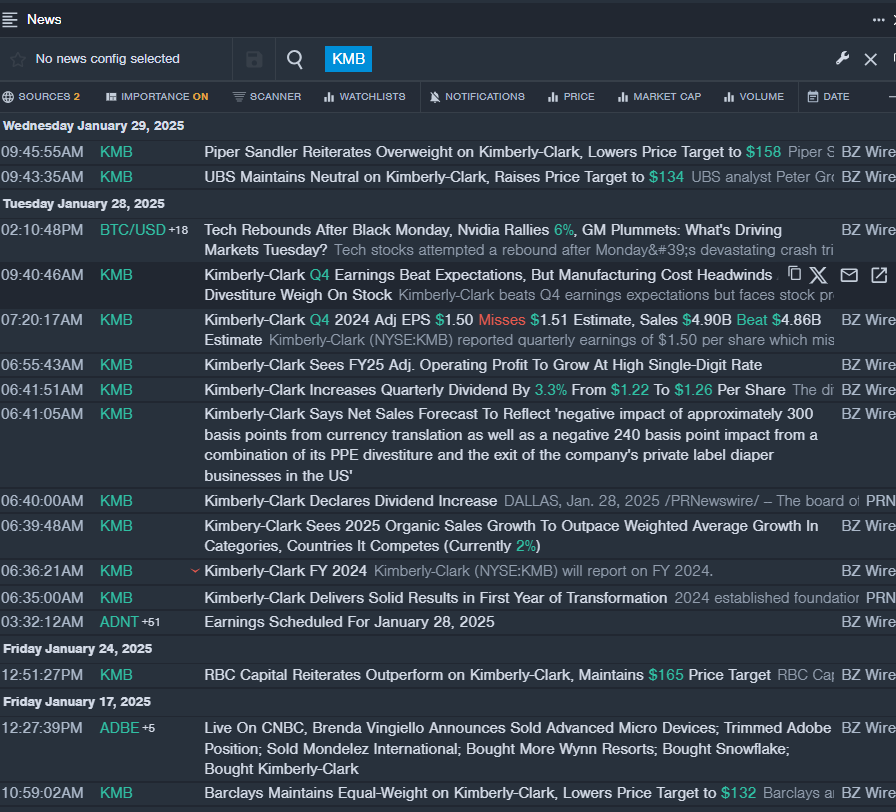

Kimberly-Clark Corporation KMB

- Dividend Yield: 3.76%

- TD Cowen analyst Robert Moskow downgraded the stock from Buy to Hold with a price target of $145 on Jan. 8, 2025. This analyst has an accuracy rate of 67%.

- Wells Fargo analyst Chris Carey maintained an Equal-Weight rating and cut the price target from $140 to $130 on Jan. 7, 2025. This analyst has an accuracy rate of 60%.

- Recent News: On Jan. 28, the company reported fourth-quarter adjusted earnings per share of $1.50, beating the street view of $1.51. Quarterly sales of $4.90 billion (down 0.8%) outpaced the analyst consensus estimate of $4.86 billion.

- Benzinga Pro’s real-time newsfeed alerted to latest KMB news

Read More:

Don't miss a beat on the share market. Get real-time updates on top stock movers and trading ideas on Benzinga India Telegram channel.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

date | ticker | name | Price Target | Upside/Downside | Recommendation | Firm |

|---|